Comprehensive Capital Solutions for Every

Financial Goal

JD Agban Group, we go beyond standard lending to offer a complete suite of financing products tailored to where you are and where you want to go. Whether you are buying your first home, expanding your commercial portfolio, or securing capital to grow your business, our integrated approach ensures you have access to the right funds with flexible underwriting and unparalleled speed. Explore our three dedicated divisions below to find the perfect capital solution for your needs.

OUR LOAN SOLUTIONS

Whether you're securing your first home mortgage, expanding your commercial real estate portfolio, or seeking business capital for growth, your financing journey requires expertise. We don't specialize in just one area; we bring the market experience from all three key sectors—Residential, Commercial, and Business—to give you a cohesive and strategic financial solution that other lenders can't match.

RESIDENTAL LOANS

Secure your property with a specialized program. JD Agban Group offers comprehensive residential financing, covering traditional Conventional, FHA, VA, and USDA loans, alongside unique solutions like Jumbo, Non-QM, ITIN, and Fix & Flip mortgages. Your goals, our expert solutions.

COMMERCIAL LOANS

JD Agban Group provides expert, customized Commercial Loan solutions. We specialize in financing for Multi-Family (5+ units), Owner-Occupied, and Investment Properties. Our expertise extends to complex financing tools like Construction and Bridge Loans, delivering the precise capital your business requires to grow and succeed.

BUSINESS LOANS

Secure the business capital required for expansion or operations. JD Agban Group provides direct access to customized Business Loans, including SBA financing, equipment leasing, and working capital solutions. We leverage our expertise to deliver the crucial funding that keeps your business competitive and moving forward.

Find Your Perfect

Capital Solution

Explore our three dedicated divisions below. Our integrated approach provides flexible underwriting and unparalleled speed across all financing sectors.

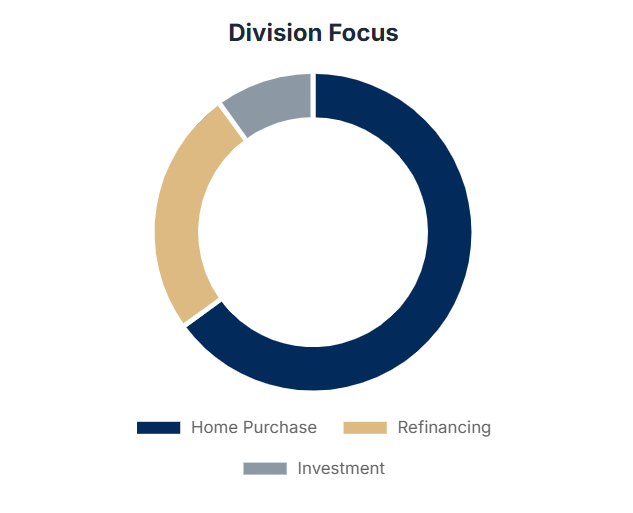

Residential Financing

For individuals and families looking to purchase a first home, refinance an existing mortgage, or invest in residential property. We provide personalized guidance to navigate the complexities of the home buying process.

Key Areas Include:

✓ First-Time Homebuyer Loans

✓ Mortgage Refinancing

✓ Jumbo & Investment Property Loans

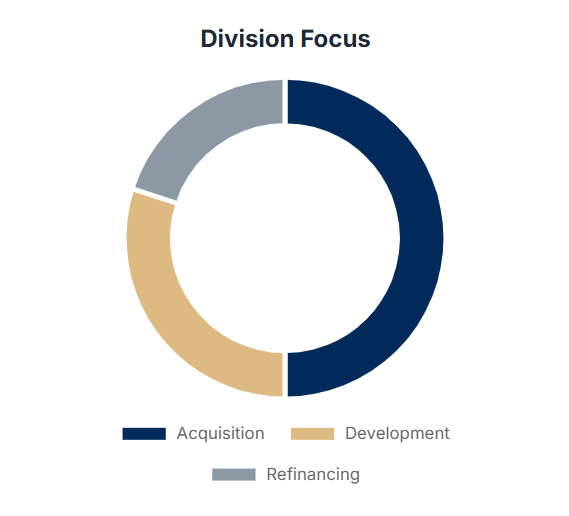

Commercial

Portfolio Expansion

For investors and developers aiming to acquire, build, or refinance commercial real estate. Our expertise covers multi-family, retail, office, and industrial properties, ensuring your investment goals are met with strategic funding.

Key Areas Include:

✓ Multi-Family Buildings

✓ Retail & Office Spaces

✓ Industrial & Warehouse Properties

Capital for

Business Growth

For entrepreneurs and established companies seeking capital to launch, operate, or expand. We offer a range of solutions from working capital lines of credit to long-term financing for major equipment and acquisitions.

Key Areas Include:

✓ SBA Loans

✓ Working Capital Lines

✓ Equipment Financing & Leasing

Loan Processing in 1, 2, 3, 4, 5-Done

A True Partner from Start to Finish. Your JD Agban Group broker simplifies complex lending into five predictable steps, guiding you through the entire process. We provide the licensed expertise and support needed to get your Residential, Commercial, or Business financing closed smoothly and with total confidence.

Initial Consultation

Meet with the client to understand their financial goals and review their current financial profile.

Application Review

Analyze submitted figures, verify accuracy, and identify the most suitable loan program based on their needs.

Loan Processing

Collect necessary documentation, conduct credit checks, and validate income, assets, employment, and other key financial details.

Underwriting and Closing

Facilitate the underwriting process and guide the client through final loan approval and closing.

Post-Closing Relationship Management

Conduct annual financial reviews to support evolving needs and maintain a long-term advisory relationship.

Start Your Loan Application Now

Thank You! Your Financing Request Inquiry is Received.

We appreciate you reaching out to JD Agban Group.

What Happens Next?

A dedicated, licensed loan specialist will be in touch 2-4 business hours during our operating hours (M–F, 9:00 AM – 5:00 PM CST).

You can also call us directly for immediate assistance at 281-624-6829

We look forward to being your trusted financing partner.

Please try again later.